Don't Stay Behind: Fast Pay-Outs In Insurance Technology

Payment technology today is about more than making and accepting payments with credit and debit cards. Today’s technology allows for consumers and businesses alike to send fast payments out, saving you time and money in the process. For insurance companies, the ability to distribute instant pay-outs on claims can be a game-changer. Your customers will appreciate it, and your business will run more smoothly.

SETOO’S FAST PAYMENT EXPERIENCE

Setoo is an insurance-as-a-service provider that has adopted fast payment service for its claims. Once it approves payment on a claim, it sends payment through Visa Direct to provide its claimants with instant access to the pay-out funds. Instead of going through the usual, antiquated process of approving, issuing, and sending a cheque, Setoo cuts through and delivers.

In addition to running more efficiently, this process delivers higher security. The electronic authorisation and delivery remove steps at which errors or theft can occur and maintains the security standards that Visa demands of its clients. The result is a service offering that sets Setoo apart from others trying to catch up in the industry.

A BETTER CUSTOMER EXPERIENCE

Some of the benefits for customers and claimants are obvious. A faster process cuts out days or more from the time they would usually have to wait to receive funds. They don’t have to watch the mail for a cheque or call to ask when it will come; it just arrives as a credit to their card or account.

The claims process has always been about more than money, though. When someone files a claim, it comes after an accident, a disaster, or a loss of some kind. They are fighting not only a financial problem but often an emotional one, too. A fast payment process that delivers funds more quickly saves your claimants much of the frustration that they typically have with their insurance companies. Giving them a positive, less painful claims experience goes a long way toward helping them move forward.

BENEFITS FOR INSURERS

Happy claimants benefit you as an insurer. In an industry much maligned for reasons that are sometimes fair and sometimes not, using fast payment technology can help you stand out in a positive way. Delivering swift claims payments gives you a chance to retain more of your current customers and gain new ones along the way.

Beyond this, fast payment technology creates instant cost savings for you. It streamlines your claims payment process to cut out steps and administrative costs. It removes opportunities for fraud and loss in your process as well, with a single, secure transaction cutting risk out of every claim payment you make.

Setoo, as an early adopter of fast payment technology, is already reaping the benefits. Getting ahead of the curve for your insurance business can help you push ahead of the pack.

Why is there a disconnect between consumer expectations and insurance?

Three key issues contribute to the disconnect between modern consumer expectations and the insurance industry:

Insurance products are not integrated seamlessly within the customer journey: Since insurance is usually sold via insurance providers, the sale is typically completed directly on their sites, even if offered first via an affiliate link. As a result, insurance is not a smoothly integrated product in the purchasing experience. Statistics show that 72% of UK consumers, and 4 out of 5 millennials, leave a website before completing the purchase because of a complex, long process. Hence, it’s highly unlikely they’ll stay engaged long enough to buy insurance...

One-size-fits-all policies are irrelevant to today's consumers: Insurers typically offer generic policies that do not address individual needs. For example, a consumer seeking guaranteed refund for excessive rain may often find that the only policy containing this feature is premium-priced as it includes protection for additional activities, such as skydiving. Another consumer may not be able to buy a single policy that provides coverage for missing luggage or a late train. The key issue here is a lack of relevancy and personalisation, which is what today’s consumers demand.

Unclear policies with tedious claims processes are unacceptable: We’re all aware of notoriously complicated claims processes, which require notifying the insurer of an incident, finding the right forms to download and complete, providing evidence such as receipts, etc. Furthermore, relevant documents have to be on-hand to verify the event is not subject to any exclusion rules. Finally, after submission, it can take weeks and even months for the insurance company to assess and process the claim. This is a far cry from millennial demands for a simple, fast and hassle-free experience.

What’s the solution? Can insurance be sold as a personalised product that simplifies the customer experience? Definitely yes, when using parametric-based, insurance-as-a-service platforms that leverage AI and machine learning technologies. This enables addressing individual customer experience pains, cutting costs, boosting sales and improving the customer journey overall to overcome the gap between consumer expectations and insurance.

About the Author

Dalya Rochman is a marketing executive with a 15-year proven track record of achievement in data-driven B2C/B2B marketing. Responsible for Customer Success in Setoo, she fully realises that the success of our customers is our success. And she intends to achieve this by combining her extensive global experience in customer management, big data platform automation systems, prediction models and analytics, with her personal “can do” approach and out-of-the box thinking.

Can insurance be an

e-business opportunity?

The online market is booming, as digitalisation enables purchasing practically everything at a click of a button. Total web-based travel sales are set to exceed $694 billion, with e-commerce reaching a value of $3.5 trillion. Inevitably, more and more e-businesses are competing over consumers' wallets, pushing them to find creative ways to stay ahead of competition and secure new revenue streams.

This reality calls for e-businesses to enhance their appeal by offering a delightful customer journey with a wide range of attractive products. Insurance is a great example of an ancillary product that can generate additional revenue, especially among travellers, who are naturally expecting to buy insurance as well.

Yet, can e-businesses successfully sell insurance without being certified or have expertise in the field? Can they really build and deliver insurance products that improve the customer experience?

To do so, challenges have to be overcome, particularly closing the gap between today’s predominantly traditional insurance products and millennial preferences for personalised, transparent and hassle-free experiences. This means seamlessly integrating insurance products into the customer journey, abandoning the one-size-fits-all approach and creating a fast and automated service; similar to the way any other online product is purchased by millennials.

Great strides are already being made in these areas with the use of fully automated insurance-as-a-service platforms. Such platforms enable e-businesses to control the creation and distribution of insurance products offered in their customer journey, without having to worry about regulation, underwriting, policy management or even compensation when needed.

Furthermore, by using these platforms, e-businesses can easily test the performance and value of the insurance products they've created, making sure their consumers are getting a relevant protection, at the right time and for a real need.

By expanding their offering to include complementary insurance products, e-businesses can:

- Achieve market differentiation that places them ahead of the competition.

- Deliver superior-value insurance options that are likely to see higher uptake, thereby surpassing the relatively low conversion rates of existing ancillary services.

- Gain consumer loyalty by providing a delightful experience with protections that address consumers' specific needs at critical moments.

This expansion of e-business offerings will enable consumers to purchase products in one place and streamline their shopping journey. It goes a long way to fulfilling the millennial requirement for simplicity and personalisation, creating enriched experiences that reduce customer churn and increase loyalty. And it bolsters the opportunity of tapping into millennial income, which is on track to top $4 trillion worldwide by 2030.

About the Author

Elana Marom is a full stack marketer who believes that marketing is about being present, relevant and adding value, alongside understanding how customers want to buy and helping them to do so. As Director of Marketing at Setoo, she’s leveraging her extensive marketing experience in start-up and enterprise environments to raise awareness about the paradigm shift evolving in the insurance industry and drive business growth.

Customer experience pains? Insurance to the rescue!

Companies worldwide are more and more focused on addressing and optimizing the customer journey. It’s a keyword that we encounter on a daily basis. But what is it? Here’s a great definition I found in SurveyMonkey: “The customer journey is the complete sum of experiences that customers go through when interacting with your company and brand. Instead of looking at just a part of a transaction or experience, the customer journey documents the full experience of being a customer.”

What’s important in this definition is that it requires an understanding of customers’ “real-world” journeys, which by nature can include different pain points. To overcome pain points, they have to be mapped, analyzed and handled, even if they cannot be resolved. While we can't always control what goes wrong, we can control how we react – and that's what makes the difference in the customer experience. Even small differences in customers’ journeys, especially as a response to something that went wrong, can have a significant impact on the experience as a whole.

Insurance is rapidly becoming a new enabler to address “real-world” pains, which have different connotations for different people, and even for the same person at different times and in different situations. For example: you finally decide to treat yourself to your dream skiing trip. You purchase a package 10 months in advance to get a better deal but are concerned there will not be enough snow and slopes may be closed. Insurance can come to the rescue through a snow guarantee protection product, allowing you to cancel or rebook your trip with full refund if there isn’t enough snow. However, if you were going camping, a snow guarantee would definitely be unsuitable; in this case your insurance rescue would be through a rainy-day protection product.

These examples indicate the direction for insurance of the future: providing personalised products that come to the rescue by resolving specific, individual pain points throughout the entire customer journey, from start to end.

This can be achieved with the integration of automation, digitisation, AI and machine learning technologies, which are turning insurance into a real solution for individual customer experience pains, as well as cutting costs, boosting sales and improving service efficiency. As a KPMG report on Powering Insurance with AI notes: “AI powered customer journey mapping and understanding customer behavior are proving to be critical tools to creating positive customer experiences and to building data sets with insights that are driving sales.”

Insurance to the rescue is a paradigm shift in the perception of the insurance industry. With relevant, personalised solutions, consumers will be encouraged to purchase insurance not out of fear and dread, but rather from a sense of receiving real protection, along with a delightful experience.

About the Author

Jonathan Arad is Director of Product Management at Setoo. For the past decade, every role he’s filled has had one common denominator – rolling-out and supporting products that address consumer needs and solve their problems and pains. At Setoo, Jonathan is leveraging the power of insurance to come to the rescue and help e businesses tackle their consumers’ pains.

Can flight delay insurance make us happier travellers?

We all want to be protected when travelling. Consumers are tired of flight delays and all the inconvenience, wasted time, incurred losses and additional expenses they entail. We also want positive experiences, particularly when it comes to compensation. Consumers are tired of long and tedious claims processes; compensation failing to take into account additional derived losses; and rigid travel insurance policies that are not tailored to individual needs.

We want flight delay insurance to be personalised and relate to consumer-specific behavior, needs and preferences, as well as offer immediate and automatic compensation.

When booking a flight, consumers get offered various add-on services such as car rental, extra luggage, special meals, better seats – and also insurance. We expect the insurance offering to be attractive and relevant just like the other products offered to us in the customer journey.

This means flight delay insurance that’s built and priced according to individual travel arrangements and potential loss. A delay means something different for someone travelling on a 1-day business trip, as opposed to a family heading out on vacation with a low-cost carrier. Hence, the flight delay insurance offered to these travellers needs to be different in terms of price, cover and compensation.

As defined by IdeaWorksCompany “revenue beyond the sale of tickets that is generated by direct sales to passengers, or indirectly as a part of the travel experience”. Bespoke insurance not only delivers consumers a better experience; it also provides a valuable ancillary revenue stream for the online travel agents that are offering the insurance.

Flight delays cannot always be avoided; however, the way such unexpected events are handled makes the difference between negative and positive customer experiences. By offering personalised, transparent and claims-free insurance, online travel agents can build loyalty among their travellers, safeguard their reputations and create a valuable stream of ancillary revenue.

And yes, albeit the delay, that will make us much happier travellers!

About the Author

Elana Marom is a full stack marketer who believes that marketing is about being present, relevant and adding value, alongside understanding how customers want to buy and helping them to do so. As Director of Marketing at Setoo, she’s leveraging her extensive marketing experience in start-up and enterprise environments to raise awareness about the paradigm shift evolving in the insurance industry and drive business growth.

Impossible to connect? Think again.

On July 7th 2005, I was traveling from Tel Aviv, Israel to Manchester, UK. Since there were no direct flights on that date, I selected a flight from Tel Aviv to London Heathrow with one airline; and a connecting flight from London to Manchester with a different airline. The 3-hour stopover in London left me ample time to collect my luggage and check-in for the local UK flight. (In those days building one’s own flight schedule with different airlines, did not yet have the fancy name –virtual interlining.)

Unfortunately, July 7th 2005 was also the day of the London underground bombings. London airports had been temporarily closed down and our takeoff from Tel Aviv was delayed by 6 hours. When I landed in London, my connecting flight was history, my ticket was worthless, and Heathrow airport was closing down for the night. I know this is an extreme example for a missed connection. Still, it happened, and no-one was prepared to compensate for taxis, hotel, new flight plans, etc.

Driven by the massive growth of low-cost carriers, globalisation and the evolution of technologies, more and more travelers are adopting virtual interlining, which addresses the journeys of passengers travelling on connecting, but non-related flights i.e., with different airlines. As consumers, this is great news. It means having the ability to tailor the most cost-efficient, optimised flight schedule.

However, as opposed to regular connections, with virtual interlining travelers are on their own, and if they miss their next flight the airline considers them a no show and pays no further attention to them. Not to mention covering for the cost of flight changes, hotels and additional transportation expenses. Online travel agents could address this issue by including missed connection coverage in their virtual interlining packages. Today, literally all travelers expect to be able to buy travel-related insurance at the click of a button, and missed connection is no exception.

The most appealing types of insurance offerings are personalised, tailored to consumers’ specific concerns and claims free. To enable such an insurance experience, online travel agents need to offer insurance products that leverage machine learning techniques alongside parametric capabilities. Similar to rain protection insurance, missed connection guarantee can also be dynamically priced to ensure it is optimised per consumer, and does not eliminate the price advantage of virtual interlining.

Finally, if something goes wrong compensation and assistance is immediate, turning a missed connection incident into an opportunity for a great connection with consumers – a moment of faith and appreciation to the online travel agent.

About the Author

Elana Marom is a full stack marketer who believes that marketing is about being present, relevant and adding value, alongside understanding how customers want to buy and helping them to do so. As Director of Marketing at Setoo, she’s leveraging her extensive marketing experience in start-up and enterprise environments to raise awareness about the paradigm shift evolving in the insurance industry and drive business growth.

Why does it always rain on me?

When an anonymous writer was once asked whether he had ever seen such a brutal winter as the icy, stormy one of 1878, he replied, "Yes, last summer." Mark Twain’s response to this was "I judge he spent his summer in Paris."

While I love living in Paris, I know the weather can be far from stable. When it comes to my summer vacation, I want the sun. And that means I’ll probably be going to Greece for 5 days. But what if it rains? My experience will be ruined.

I know it’s not possible to guarantee the weather. But in this day and age, there should be endless options for personalised insurance products – just as I have endless options when purchasing clothing online, selecting a smartphone or a summer vacation package. What I want is to be offered a bespoke insurance product giving me rainy day protection when I book my summer vacation. That way, I can at least receive compensation if it rains, and have available cash for finding better suited activities that I can still enjoy.

Sounds far-fetched? Actually not, it’s already becoming a reality! Parametric insurance, also referred to as a new spin on an old product, enables insuring against a wide range of risks, which previously were not enabled. This is possible through the integration of machine learning and predictive models, which enable insurance solutions even in fast-changing climates.

All this indicates that the product I want can be personalised to my vacation – location and dates – by calculating a specific premium based on the summer weather patterns in Greece. And it also means that claims handling can be completely automated, based on external data sources of rain prediction. Such sources retrospectively indicate the amount of precipitation every 24 hours, enabling smart insurance platforms to ascertain whether there is a claim. If that’s the case, payment of the claim is automatic, so this means I will get compensated immediately without having to do claim or prove anything.

Mark Twain also said, "Climate is what we expect, weather is what we get". But if Mark Twain was an insurance customer like me – demanding a straightforward, personalised and worry-free insurance experience – he’d probably say, "Weather is what we expect, insurance is what we should get."

About the Author

As Business Development Director at Setoo, Julien Carmona brings a 10-year track record in corporate strategy, business development and successful digital transformation implementation in various industries. Passionate about disruption and digital models, Julien is also very familiar with the innovation ecosystem in Europe and the US.

Empires on edge? Time to focus right and grow

The Phocuswright Europe 2019 Empires on Edge event last week was an eye-opening and rewarding experience. One of the main topics discussed was “New Experiences: How tours and activities disrupt the European tour operator market and challenge destination marketers”. From my point of view, that’s because the disruption is accompanied by the need for millennial-friendly insurance products, which are aligned to the disruption that the travel market is undergoing.

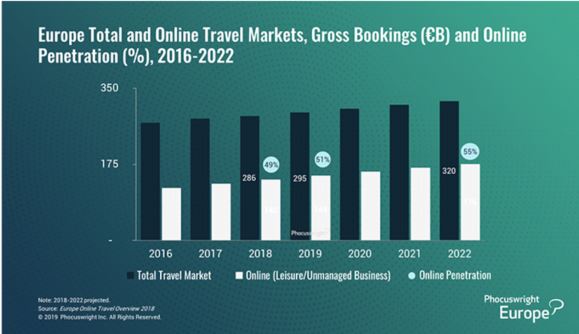

First consider the statistics. European consumers are focused on leisure travel. The percentage of adults who travel annually in Europe’s three largest markets is 59% in France, 61% in Germany, 60% in the UK. An annual growth of roughly 3% in Europe’s travel market will deliver a €320 billion market in 2022.

That’s a huge potential market for e-businesses such as OTAs to grow. By leveraging the right solutions and technologies that deliver the best experiences to consumers, any online interaction can also be an opportunity for an insurance transaction, thereby monetizing the market opportunity and ensuring a win-win-win situation for consumers, e-businesses and insurers.

Why are such online insurance transactions a win-win-win for all? For consumers, they are simple and trustworthy solutions to real travel concerns, providing worry-free and hassle-free insurance with immediate compensation; and most importantly no need for any claims process. For insurers, they offer a new distribution channel – automated insurance processes that maintain full control of possible risks and eliminate the possibility of fraud. And for e-businesses, they generate ancillary revenue and improve conversion rates alongside enhancing consumers’ loyalty.

Phocuswright was a great place to share ideas and gain insights. And for us at Setoo, it was rewarding. Winning two awards – Travel Innovator of the Year and Homeaway Travel Innovation – proved to us that we are “focused right”. It confirmed that our mission to empower e-businesses to turn insurance into products consumers love is exactly what the market is demanding, enabling innovative OTAs and other e-businesses to create a delightful insurance experience for their consumers through simple, personalized and claims-free insurance products.

About the Author

Elana Marom is a full stack marketer who believes that marketing is about being present, relevant and adding value, alongside understanding how customers want to buy and helping them to do so. As Director of Marketing at Setoo, she’s leveraging her extensive marketing experience in start-up and enterprise environments to raise awareness about the paradigm shift evolving in the insurance industry and drive business growth.

From reactive to proactive – can insurance transform? Part 2

Last post ended with thoughts on how insurers can succeed in transforming their approach from reactive to proactive, and create stronger connections with consumers, who are compelling insurance players to reshape the way they package and sell their products.

Today, this isn’t a technological challenge – all the technologies needed for the transformation are available and mature. The innovation around AI and machine learning, in addition to the proliferation of data and ability to connect to external data sources, offer the opportunity for change and a new type of insurance experience.

This change can best be achieved through implementation of an insurance platform that integrates advanced machine learning models and can support actuarial practices and big data analytics. Such platforms can process millions of events in real time, from flight schedules and luggage tracking to weather forecasts, price fluctuations and delivery schedules. Furthermore, machine learning enables the use of historical data, as well as facilitates a competitive approach to product offerings, pricing, customer communications and claims handling.

A smart insurance platform provides insurers with the ability to automatically and accurately assess endless possible risk scenarios. Applying appropriate mathematical models, it’s possible to predict the probability of customer experience disruption – in terms of frequency and severity – at the highest level of granularity, in order to determine adequate underwriting rules. Additionally, triggers based on real-time data, such as if a flight is late, whether there’s sufficient snow for skiing or if luggage has gone missing, enable automatically triggering a policy and generating immediate payment of compensation.

This is a game changer in the insurance experience, and especially essential for millennial consumers who expect nothing less than proactive, personalised and fully automated insurance products. In fact, consumers who perceive their insurers to be proactive indicated a 15.7% increase in positive experience. Furthermore, 40% of the millennial generation and 45.7% of tech-savvy customers indicated willingness to share their data for the benefit of receiving personalised services.

The benefits of such services are clear:

- Proactive predictions of consumers’ individual needs in various areas.

- Real-time monitoring of risks and staying one step ahead of consumers to ensure a seamless customer journey.

- Worry-free and hassle-free experience through automated claim and compensation processes.

- Vast reduction in operational cost required by manual claims processes, enabling insurers to offer services at lower rates making them more attractive to consumers.

Adopting a proactive, millennial-ready insurance approach is becoming inevitable. The ability to predict and respond quickly to shifting consumer attitudes, market opportunities and risks is essential for gaining customers, alongside keeping them happy and ensuring long-term business sustainability.

About the Author

Eyal Gluska’s entire career has been focused on creating innovative services and business models that generate new business opportunities for leading organizations around the world. As co-CEO of Setoo, he wants to disrupt the insurance industry with AI and state-of-the-art machine learning technologies, automating human-intensive operations to transform the way insurance products are created and delivered.

From reactive to proactive – can insurance transform? Part 1

According to the World Insurance Report, “business-as-usual within the insurance industry is coming to an end”, and as consumer demands and market dynamics continue to evolve at great speed, the ability to a adopt a proactive approach will become even more vital for insurance players.

How has this situation evolved? Basically, it’s because traditional insurance is reactive – an event occurs, and the insured party makes a claim – and this approach does not meet the experience expectations of consumers today.

The claims process is long and tiring and it consistently leaves consumers resentful and angry due to the massive amount of bureaucracy involved; the disputes concerning actual compensation; and the time it takes to actually receive compensation. Often, consumers give up the fight, conceding to the insurers.

Today’s digital and customer-centric era demands a change, and to attract and retain customers the insurance industry has to adapt accordingly. Some insurers are already moving from a traditional reactive insurance experience to a predictive and proactive one; a new type of insurance offering based on parametric capabilities, AI, machine learning, big data, analytics, etc.

This enables defining the probability of something happening and automatically compensating the consumer if it happens, thereby eliminating the exhausting claims process. Even if the types of insurance products remain traditional, the customer experience and claims process need to transform and become up-to-date and millennial-ready.

Consider flight delay insurance. In the reactive approach, if a flight is delayed, consumers need to inform the insurer of the delay after landing, and then have to start the long claim process of providing documents to prove they were on the flight, that the flight was late, etc. On the other hand, imagine the same product in a proactive approach: the insurer knows the plane was delayed (even before the consumer), and thus can provide immediate compensation and further assistance, which prevents consumer frustration and creates a sense of trust and loyalty.

Sounds like a pipedream? It’s not. Some insurers are already transforming from reactive to proactive, embracing a new approach, changing the role of insurance and fundamentally strengthening the relationship between insurers and consumers.

How are they achieving this? See part 2 of this blog next week.

About the Author

Eyal Gluska’s entire career has been focused on creating innovative services and business models that generate new business opportunities for leading organizations around the world. As co-CEO of Setoo, he wants to disrupt the insurance industry with AI and state-of-the-art machine learning technologies, automating human-intensive operations to transform the way insurance products are created and delivered.